Target-date funds automatically adjust underlying allocations to less risky investments over time as they related to a specified future date, typically an investors target retirement date.

Target-Date Funds (TDFs) have long been a popular choice among investors, employers, and retirement plan administrators as a way of maintaining a single investment product that can be held over many years.

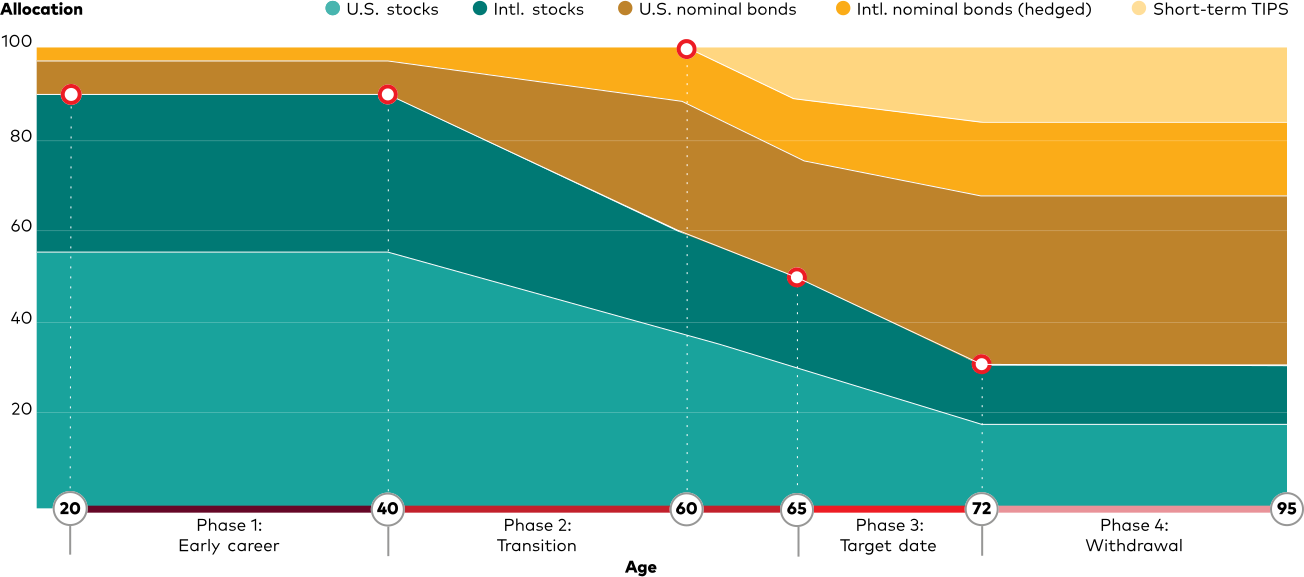

As illustrated below, TDFs use a “glide path” to gradually shift the underlying investments in more volatile asset classes, such as stocks, to less volatile asset classes, such as bonds and cash. TDFs are viewed as a simple investment selection as each has a specific year in the name, which should correlate to the investors targeted retirement year.

Although a glide path can make TDFs seem appealing to investors, the convenience of these investment vehicles should not be the only consideration. There are four common misconceptions related to TDFs and glide paths that we believe should be understood before making a long-term investment decision.

Misconception #1: "My investment portfolio should be conservative as I approach retirement."

This idea is certainly based on sound logic, but the matter of when to be more conservative in relation to your expected retirement date is a different concept. A glide path intends to manage investment volatility, but volatility during working years is much less important compared to retirement. We believe long-term investors should maintain a given allocation for a full market cycle, typically lasting an average of five years.

This means volatility is almost irrelevant until you are around five years away from receiving distributions from your investment account(s). In general, TDFs can transition too conservative too quickly, leading to underperformance in the some of the most paramount years. Over the course of your working years, investing too heavily in less volatile asset classes like bonds hinders growth potential.

On the other hand, investing too heavily in more volatile asset classes during retirement could lead to realizing large losses while you are simultaneously withdrawing money from those accounts, thus depleting your assets quicker.

Misconception #2: "Reducing risk is good."

Volatility and risk are two different principles. Volatility is a measure of how investments fluctuate around their average, while investment risk is the possibility of experiencing a loss.

For example, if the average annual return of a US stock index is +10%, and we assume the volatility of that index is 17% (as measured by standard deviation), we can expect most annual returns would fall between -7% and +27% (10% ± 17%). Stocks can be more volatile than other types of investments, but remaining invested in the referenced stock index over a full market cycle reduces the odds of realizing a loss.

Of course, the ultimate risk is the risk of running out of money, so there may be instances where you need to accept higher volatility to meet your long-term financial goals.

Misconception #3: "Target-date funds are great diversifiers."

Diversification, while a prudent concept, is not always applied correctly. For example, owning a single oil stock and choosing to “diversify” by adding other oil and natural gas stocks does not add meaningful diversification to a portfolio.

TDFs invest heavily in core bond funds, which attempt to duplicate the performance of the total bond market. With the 10-year average return of U.S. bonds being 1.4%, what does a younger investor truly gain by over-allocating to the TDF bonds over those 10 years? This is where TDFs fail to add true diversification.

In today’s interest rate environment, floating rate bonds and high-yield bonds offer higher growth potential compared to a U.S. bond index. Investing in bonds can add diversification and lower volatility, but allocating to the appropriate asset segments is critical to ensure you do not sacrifice higher returns in the name of diversification.

Misconception #4: "The ease of use is worth the fees."

We believe implementing index-style strategies for most public equity (stocks) and public credit (bonds) allocations is most favorable due to the lower cost, tighter tracking error, and simplistic approach compared to TDFs and active managers.

Many stock index funds contain an average expense ratio of 0.015% - 0.06%, while the average TDF has an expense ratio of 0.68%. Relative to TDFs, we believe professional, personalized investment management can more effectively manage volatility, reduce expenses, add meaningful diversification, and improve total investment performance.

Key Takeaway

The investment marketplace can be very difficult to navigate, and investment decisions should not be taken lightly. While there are many options, there are foundational steps to take that can help position your portfolio for exactly what you need, when you need it.

The team at LGT Financial Advisors is ready to help you select appropriate investments that are aligned with your financial goals.

To learn more, contact one of our trusted advisors.